Why Update Accounting Software for UK SMEs in 2026

- Richard Ellis

- 3 days ago

- 7 min read

Managing the finances of a small business in Garforth or Leeds often means juggling endless paperwork and staying alert to new compliance rules. As UK accounting standards evolve, business owners face rising pressure to keep their records accurate and up-to-date. Modern accounting software now needs to deliver real-time data processing and full compliance with Make Tax Digital and the changing UK GAAP. Discover how the right choice today could simplify both your daily operations and long-term financial health.

Table of Contents

Key Takeaways

Point | Details |

Adoption of Modern Accounting Software | UK SMEs should prioritise updated accounting solutions to meet regulatory demands and enhance financial insights. |

Compliance with Making Tax Digital | Ensuring compliance with MTD regulations is crucial for all UK businesses starting from April 2026. |

Cloud Accounting Benefits | Embracing cloud technologies can significantly improve operational efficiency and collaboration for SMEs. |

Risks of Outdated Systems | Legacy accounting systems expose companies to compliance failures, operational inefficiencies, and cybersecurity threats. |

Defining Updated Accounting Software Today

Modern accounting software for UK small and medium enterprises (SMEs) in 2026 represents far more than a digital ledger. It’s a sophisticated financial management ecosystem designed to meet increasingly complex regulatory demands and provide real-time business insights. UK accounting standards are undergoing significant transformations that require software to be adaptive, intelligent, and compliant.

The key characteristics of updated accounting software today include several critical features:

Real-time data processing enabling instantaneous financial reporting

Seamless integration with tax compliance workflows

Advanced revenue recognition capabilities

Comprehensive lease accounting support

Cloud-based accessibility for remote financial management

Automated compliance with UK GAAP and IFRS standards

These technological advancements reflect the evolving needs of UK businesses. Accounting software in 2026 must handle complex regulatory requirements while providing actionable financial intelligence. Modern solutions go beyond traditional bookkeeping, transforming into strategic business tools that help SMEs make informed decisions.

Companies must now view accounting software not as an optional expense, but as a critical infrastructure for financial management. The right software can streamline operations, reduce compliance risks, and provide unprecedented visibility into financial performance.

Pro tip: Conduct a comprehensive software audit annually to ensure your accounting technology remains aligned with the latest regulatory standards and business requirements.

Types of Software and Key Features

Accounting software for UK small and medium enterprises (SMEs) has evolved dramatically, offering a range of solutions tailored to different business needs. Accounting platforms now provide comprehensive functionality that extends far beyond traditional bookkeeping, transforming financial management into a strategic business tool.

The primary types of accounting software available in 2026 include:

Cloud-based systems

Multi-user accessibility

Real-time data synchronisation

Mobile app integration

Desktop solutions

Localised data storage

Enhanced security controls

One-time purchase options

Hybrid platforms

Flexible deployment

Combination of cloud and local storage

Customisable infrastructure

Key features that UK SMEs should prioritise in their accounting software selection include:

Making Tax Digital (MTD) compliance

Automated VAT reporting

Bank reconciliation capabilities

Integrated payroll management

Advanced invoicing tools

Expense tracking functionality

Accounting software selection requires careful consideration of specific business requirements, scalability, and long-term strategic alignment. The right platform can dramatically streamline financial processes, reduce manual errors, and provide actionable insights that drive business growth.

To help distinguish the main software options, here is a comparison of accounting software types and their practical suitability:

Software Type | Best For | Key Advantage | Long-term Consideration |

Cloud-based | Growing, mobile SMEs | Access from any location | Automatic updates and scaling |

Desktop | Security-focused firms | Local data control | Manual updates often required |

Hybrid | Customised operations | Combines online and local benefits | Flexible, needs IT oversight |

Modern accounting solutions are no longer just record-keeping tools. They represent intelligent financial ecosystems that enable SMEs to make data-driven decisions, maintain regulatory compliance, and optimise their financial operations.

Pro tip: Schedule quarterly reviews of your accounting software’s performance and features to ensure continued alignment with your evolving business needs.

Making Tax Digital and Legal Compliance

The UK’s tax landscape is undergoing a significant digital transformation, with Making Tax Digital (MTD) representing a crucial regulatory shift for small and medium enterprises. Digital tax submission requirements mandate specific compliance standards that fundamentally change how businesses manage their financial reporting.

Key MTD compliance requirements for UK businesses include:

Mandatory digital record-keeping

Quarterly tax information submissions

Use of HMRC-approved software

Digital tax return filing

Automated data tracking

Real-time financial reporting

MTD regulations will impact sole traders and landlords with specific income thresholds, requiring them to adopt digital accounting practices. The implementation timeline is critical, with full enforcement expected from April 2026. Businesses must proactively prepare by:

Evaluating current accounting systems

Identifying MTD-compatible software

Training staff on new digital reporting processes

Ensuring data integrity and security

Implementing seamless digital record-keeping

The primary objective of Making Tax Digital is to reduce errors, improve tax accuracy, and create a more transparent financial ecosystem for UK businesses. By mandating digital tools and processes, HMRC aims to streamline tax administration and provide businesses with more sophisticated financial management capabilities.

Pro tip: Conduct a comprehensive software compatibility audit at least six months before the April 2026 deadline to ensure smooth MTD transition.

Efficiency, Integration, and Cloud Benefits

Cloud accounting technologies are revolutionising financial management for UK small and medium enterprises, offering unprecedented operational advantages. Cloud accounting adoption transforms business efficiency by providing flexible, intelligent solutions that streamline complex financial processes.

Key efficiency benefits of cloud accounting include:

Anywhere-accessibility

Work from multiple locations

Real-time data synchronisation

24/7 financial information access

Automated workflows

Reduced manual data entry

Automatic reconciliation

Error minimisation

Seamless integration

Connected business ecosystems

Multi-tool compatibility

Centralised financial management

The technological advantages extend far beyond simple record-keeping. Modern cloud platforms enable businesses to:

Collaborate in real-time

Generate instant financial reports

Implement robust security protocols

Scale technological infrastructure effortlessly

Reduce operational technology costs

By embracing cloud-based accounting solutions, UK SMEs can transform their financial management from a reactive administrative task to a strategic business intelligence function. These platforms provide actionable insights, improve decision-making capabilities, and create a more agile business environment.

Pro tip: Conduct a comprehensive cost-benefit analysis of cloud accounting solutions, focusing on integration capabilities and long-term scalability.

Financial Risks of Outdated Systems

Outdated accounting systems represent a critical threat to UK small and medium enterprises, exposing businesses to multifaceted financial and operational vulnerabilities. Accounting system risks extend far beyond simple technological limitations and can potentially compromise an entire organisation’s financial integrity.

The primary financial risks associated with legacy accounting systems include:

Compliance Failures

Breach of new accounting regulations

Potential significant financial penalties

Non-compliance with Making Tax Digital mandates

Operational Vulnerabilities

Increased manual error rates

Delayed financial reporting

Inefficient workflow management

Cybersecurity Threats

Outdated security protocols

Higher vulnerability to data breaches

Increased ransomware risks

Cybersecurity risks in unsupported software can create substantial financial exposure. Businesses might encounter unexpected challenges such as:

Emergency technology replacement costs

Potential legal liabilities from data breaches

Reputation damage from security incidents

Loss of customer trust

Potential business interruption

UK SMEs must recognise that their accounting software is not merely a technological tool but a critical financial infrastructure that directly impacts operational resilience, regulatory compliance, and strategic decision-making. Investing in modern, secure, and adaptable accounting systems is no longer optional but a fundamental business necessity.

The following table summarises the main risks of outdated accounting systems and their business consequences:

Risk Category | Business Impact | Typical Outcome |

Compliance Failures | Regulatory penalties and investigations | Increased costs, potential fines |

Operational Issues | Slower processing, more errors | Inefficient and delayed reporting |

Cybersecurity Threats | Data breaches, ransomware exposure | Loss of trust, possible lawsuits |

Pro tip: Schedule a comprehensive technology audit annually to identify potential system vulnerabilities and ensure ongoing compliance with evolving regulatory standards.

Choosing and Implementing the Right Update

Selecting the appropriate accounting software represents a critical strategic decision for UK small and medium enterprises in 2026. Successful software implementation requires comprehensive planning that goes beyond simple technological considerations, encompassing organisational culture, workflow transformation, and long-term business objectives.

Critical factors to consider during software selection include:

Compliance Requirements

HMRC recognition

Making Tax Digital compatibility

Automated VAT reporting

Functional Capabilities

Bank integration

Payroll management

Multi-user accessibility

Technical Considerations

Cloud vs desktop options

Scalability potential

Security infrastructure

Accounting software selection involves multiple strategic steps that businesses must methodically navigate:

Conduct comprehensive needs assessment

Research HMRC-approved platforms

Evaluate integration capabilities

Schedule detailed vendor demonstrations

Plan phased implementation strategy

Implementation success hinges on thorough staff training, careful data migration, and gradual system rollout. Companies must view this process as a strategic transformation rather than a mere technological upgrade, ensuring that new systems align with broader organisational goals and enhance operational efficiency.

Pro tip: Involve key finance team members throughout the software selection process to ensure user-centric implementation and maximise system adoption.

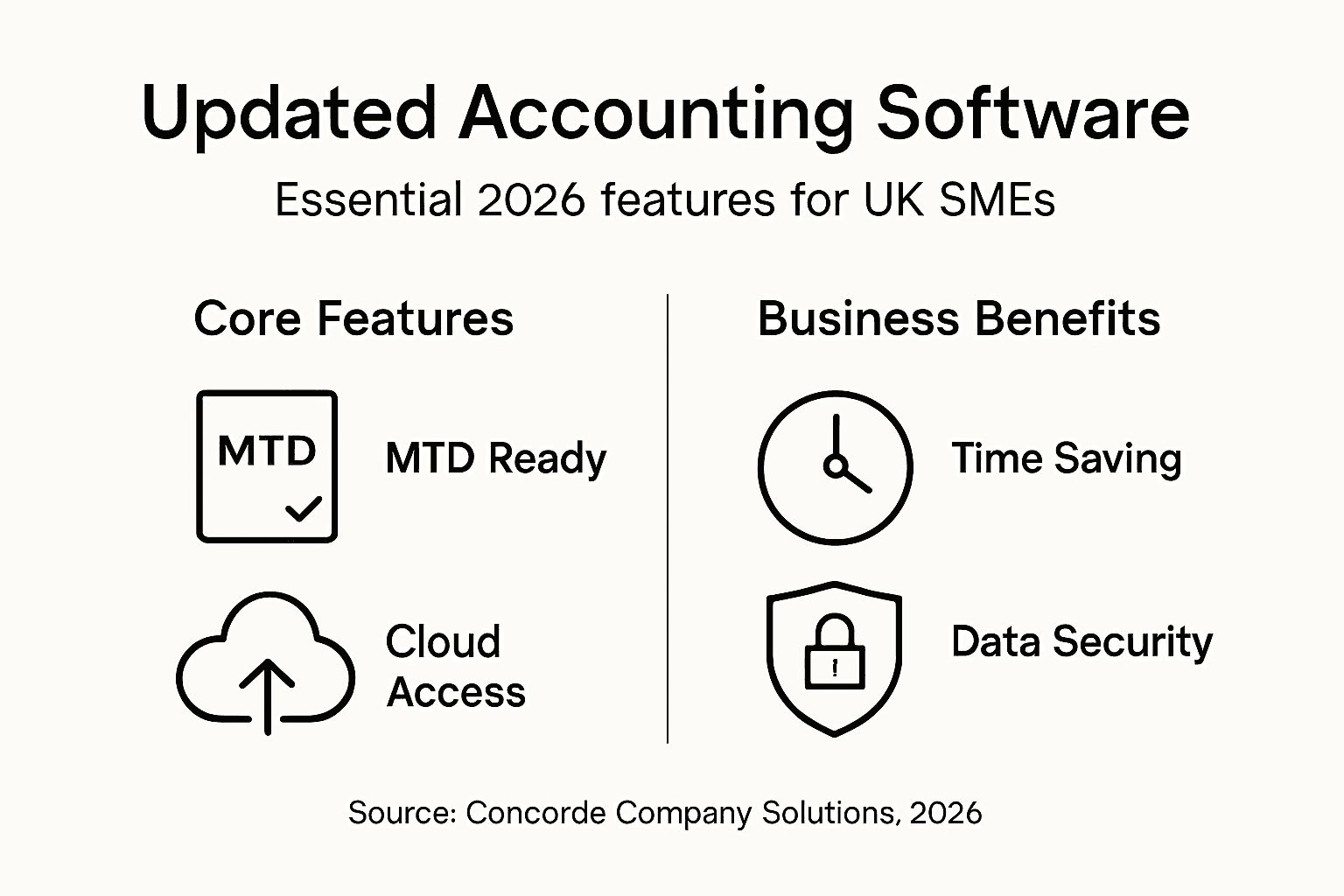

Secure Your Financial Future with Expert Accounting Support

Updating your accounting software to meet the latest 2026 standards is not just a technical upgrade but a vital step to avoid compliance risks, costly errors, and data security threats. Concorde Company Solutions understands the challenges UK SMEs face with Making Tax Digital requirements and complex regulatory changes. Our team offers personalised support to help you select and implement the ideal accounting software that ensures full HMRC compliance and streamlines your financial operations.

Don’t risk penalties or operational setbacks because of outdated systems. Visit Concorde Company Solutions now to discover how our expert bookkeeping, payroll management, and software setup services can transform your business. Act today to secure tailored solutions that keep your accounts accurate, compliant, and strategically aligned with your growth objectives.

Frequently Asked Questions

Why is it essential to update accounting software for SMEs in 2026?

Updating accounting software is crucial for SMEs to comply with evolving regulatory requirements, such as Making Tax Digital, and to leverage advanced features for real-time financial insights and improved operational efficiency.

What are the key features to look for in accounting software for SMEs in 2026?

Key features include real-time data processing, compliance with UK GAAP and IFRS standards, MTD compatibility, advanced invoicing tools, automated VAT reporting, and cloud-based accessibility for flexible financial management.

How does cloud accounting differ from desktop solutions for SMEs?

Cloud accounting offers benefits such as multi-user accessibility, real-time data synchronisation, and automatic updates, while desktop solutions allow localised data storage and enhanced security controls, often requiring manual updates.

What are the risks associated with using outdated accounting systems?

Using outdated accounting systems exposes SMEs to compliance failures, operational inefficiencies, and increased cybersecurity threats, which can lead to significant financial penalties, delayed reporting, and potential data breaches.

Recommended

Comments