What Is Companies House Filing? Complete Guide UK

- David Rawlinson

- Dec 3, 2025

- 7 min read

Over 98 percent of british businesses registered each year must meet strict filing rules at Companies House. Compliance is not only a legal expectation but a core part of maintaining trust and transparency in the market. Knowing exactly when and how to submit your company accounts can prevent unwanted penalties while keeping your business in good standing with authorities. This guide gives you clear answers so you can meet every requirement with confidence.

Table of Contents

Key Takeaways

Point | Details |

Annual Filing Requirements | All limited companies in the UK must file annual accounts with Companies House, regardless of trading status, to maintain transparency and regulatory compliance. |

Types of Required Documents | Companies need to submit specific documents, including full accounts, abridged accounts, and profit and loss statements, tailored to their size and status. |

Penalties for Non-Compliance | Failing to meet filing deadlines can result in financial penalties, legal action against directors, and even company dissolution, making timely submissions critical. |

Common Filing Mistakes | Businesses should avoid common errors such as missed deadlines and incomplete documentation by implementing rigorous record-keeping and filing processes. |

Understanding Companies House Filing Basics

Companies House is the official registrar of companies in the United Kingdom, responsible for maintaining a comprehensive public record of all registered businesses. Every limited company, regardless of its trading status, must submit specific documentation to this government agency annually. Limited company compliance requires precise filing procedures that help maintain transparency and legal accountability.

The primary requirement for all UK registered companies is annual account filing, which involves submitting financial statements and key business information. According to government guidance, this obligation applies universally - even for dormant or non-trading enterprises. These filings serve multiple crucial purposes:

Providing transparency about a company’s financial health

Enabling public access to essential business information

Supporting regulatory oversight of business operations

Maintaining accurate corporate records

Companies must submit their accounts electronically through the Companies House web filing system, typically within specific timeframes depending on their company structure. Small companies and micro-entities have different filing requirements compared to larger corporations, with simplified reporting standards designed to reduce administrative burdens. The filing process involves preparing accurate financial statements, including profit and loss accounts, balance sheets, and directors’ reports, which must be submitted before the prescribed deadline to avoid potential penalties.

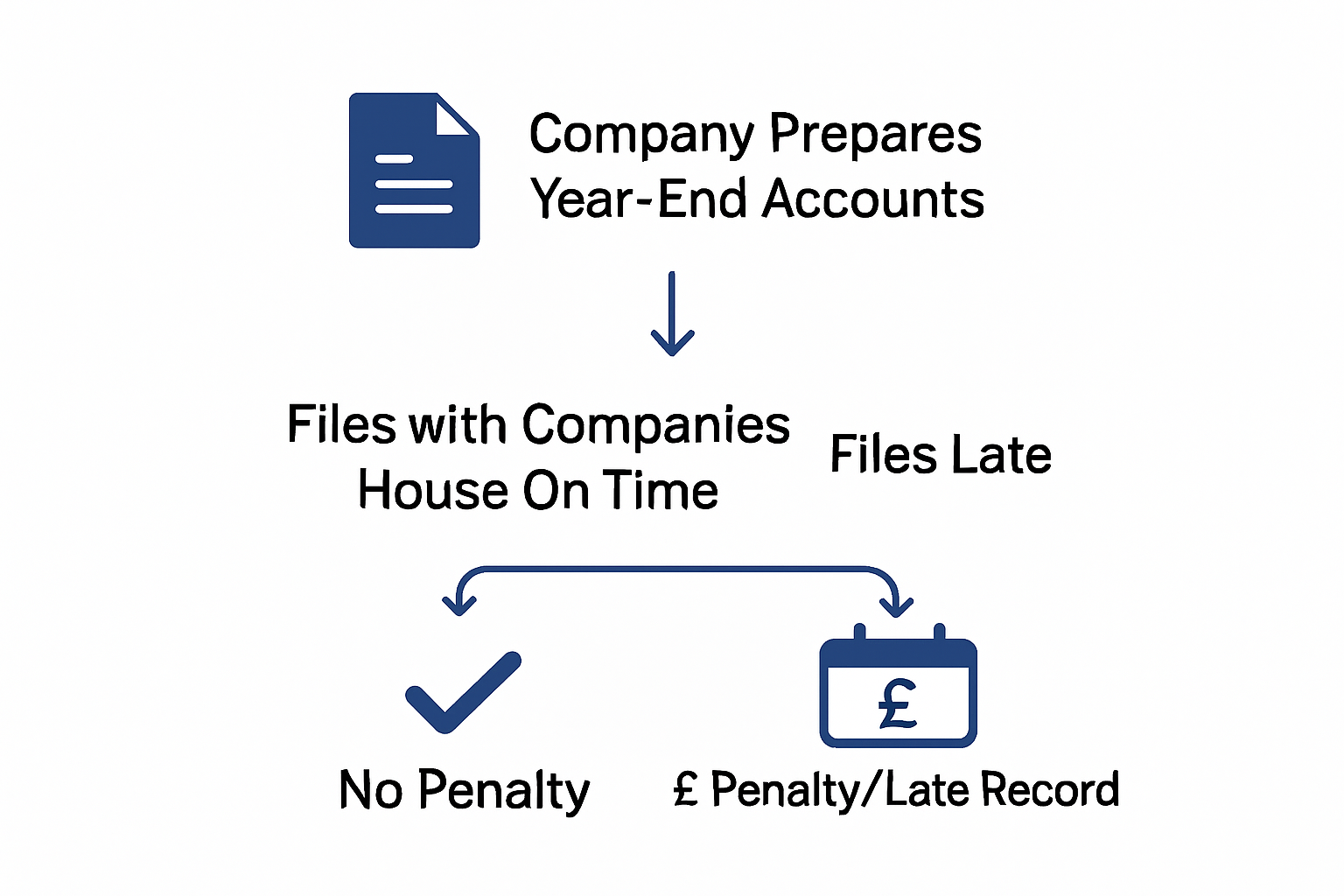

Failure to file accounts on time can result in significant consequences, including financial penalties, potential legal action, and the risk of compulsory company strike-off. Business owners must therefore stay informed about their specific filing obligations and maintain meticulous financial records throughout the accounting period.

Types of Documents Filed With Companies House

Businesses operating in the UK must file several critical documents with Companies House, each serving a distinct purpose in maintaining corporate transparency and regulatory compliance. Limited company accounts vary depending on the company’s size and structure, with different reporting requirements for small, medium, and micro-entities.

According to government guidance on annual accounts, companies are required to submit multiple document types, which can be categorised into primary financial statements:

Full Accounts: Comprehensive financial reports for larger companies

Abridged Accounts: Simplified financial statements for smaller enterprises

Micro-Entity Accounts: Minimal reporting for the smallest businesses

Directors’ Reports: Mandatory statements detailing company leadership and strategic overview

Profit and Loss Accounts: Detailed income and expenditure statements

Balance Sheets: Snapshot of company assets, liabilities, and financial position

The specific documentation required depends on a company’s annual turnover, balance sheet total, and number of employees. Smaller companies benefit from reduced reporting obligations, allowing them to file more concise financial information. Larger corporations must provide more detailed accounts, including comprehensive notes and additional financial disclosures.

Companies must ensure timely and accurate filing, as incomplete or late submissions can result in financial penalties and potential legal consequences. Business owners should carefully review their specific filing requirements and maintain meticulous financial records to facilitate smooth annual reporting to Companies House.

Who Must File and Key Deadlines

Every limited company registered in the United Kingdom is legally required to file accounts with Companies House, regardless of whether the business is actively trading. Annual accounts filing process involves specific obligations that vary depending on the company’s size, structure, and financial performance.

According to government regulations, the following entities must file accounts:

Limited Companies: Mandatory filing for all registered limited companies

Dormant Companies: Required to submit dormant account statements

Micro-Entities: Small businesses with simplified reporting requirements

Partnerships: Specific filing requirements based on business structure

Community Interest Companies (CICs): Mandatory annual reporting

Key filing deadlines differ based on company type and financial year-end date. Limited companies must typically submit their accounts within nine months of their accounting reference date for private companies, and six months for public limited companies. First-time filers have slightly extended deadlines, allowing new businesses additional time to prepare comprehensive documentation.

Companies failing to meet these deadlines face significant penalties, including financial fines and potential legal consequences. Directors can be held personally responsible for late or incomplete submissions, making timely and accurate filing crucial for maintaining good standing with regulatory authorities. Business owners should maintain meticulous financial records and plan ahead to ensure smooth and punctual Companies House submissions.

Common Filing Mistakes and How to Avoid Them

Companies House filing can be complex, with numerous potential pitfalls that can lead to penalties and administrative headaches. Tax return tips for small businesses often highlight the importance of meticulous record-keeping and timely submission.

According to government guidance on annual requirements, the most common filing mistakes include:

Missed Deadlines: Failing to submit accounts within the prescribed timeframe

Incomplete Documentation: Submitting partial or incorrect financial statements

Incorrect Filing Format: Using outdated or non-standard submission methods

Inaccurate Financial Reporting: Providing misleading or incorrect financial information

Overlooking Small Company Exemptions: Not applying appropriate reporting thresholds

To prevent these errors, businesses should implement robust financial management practices. This includes maintaining up-to-date accounting records, setting internal reminders for filing deadlines, and conducting thorough reviews of financial documents before submission. Smaller companies and start-ups are particularly vulnerable to these mistakes, often due to limited administrative resources or inexperience with regulatory requirements.

Professional accountants recommend creating a comprehensive filing checklist, investing in reliable accounting software, and seeking expert guidance when navigating complex reporting requirements. The potential consequences of filing mistakes can be severe, ranging from financial penalties to legal complications that could impact the company’s reputation and operational capabilities. Proactive preparation and attention to detail are crucial in ensuring smooth and compliant Companies House submissions.

Legal Implications and Penalties for Non-Compliance

Companies House takes regulatory compliance extremely seriously, with a robust framework of legal consequences designed to ensure transparency and accountability in business reporting. Limited company compliance requires businesses to understand the potential ramifications of failing to meet statutory obligations.

According to government guidance on late filing penalties, non-compliance can result in escalating legal consequences, including:

Initial Financial Penalties: Fixed fines starting from £150 for minor delays

Escalating Fines: Increased penalties for consecutive late submissions

Public Record Annotations: Negative markers on the company’s official record

Potential Criminal Prosecution: Risk of legal action against company directors

Company Dissolution: Potential forced strike-off from the Companies Register

The severity of penalties increases dramatically with repeated non-compliance. Small businesses and start-ups are particularly vulnerable, as they may lack dedicated administrative resources to manage complex filing requirements. Directors can be held personally liable for persistent failures, which can impact future business opportunities, credit ratings, and professional reputations.

Businesses must treat Companies House filing as a critical statutory obligation. The potential consequences extend far beyond immediate financial penalties, potentially threatening the entire operational status of the company. Professional accountants recommend implementing robust compliance systems, maintaining meticulous financial records, and seeking expert guidance to navigate the complex landscape of regulatory requirements.

Ensure Your Companies House Filing Is Accurate and On Time

Navigating Companies House filing can be overwhelming with tight deadlines and complex document requirements. Many businesses struggle with avoiding penalties due to missed submissions, incomplete accounts, or incorrect formats. If you want to eliminate the stress of compliance and gain peace of mind, expert support is essential. Concorde Company Solutions specialises in helping small and medium enterprises stay fully compliant by managing your annual accounts, filing deadlines and statutory obligations with precision.

Take control of your financial reporting today. Our dedicated team offers tailored services including statutory accounts preparation and filing, bookkeeping, and personalised guidance designed around your unique business needs. Avoid costly errors and legal risks by choosing professional assistance you can trust. Visit Concorde Company Solutions now and discover how we simplify the Companies House filing process. Start the conversation for hassle-free compliance and let us be your reliable partner every step of the way.

Frequently Asked Questions

What is Companies House filing?

Companies House filing refers to the process by which UK registered businesses submit specific documentation, including annual accounts and reports, to maintain a public record and ensure compliance with legal obligations.

Who is required to file accounts with Companies House?

All limited companies, including dormant and micro-entities, are required to file accounts with Companies House, regardless of whether they are actively trading.

What are the consequences of failing to file accounts on time?

Consequences of late filing can include financial penalties, public record annotations, potential legal action against directors, and even compulsory company dissolution.

What types of documents must be submitted to Companies House?

Businesses must submit various documents, including financial statements, directors’ reports, profit and loss accounts, and balance sheets, depending on the company’s size and structure.

Recommended

Comments