Why Use Cloud Accounting for UK Businesses

- Richard Ellis

- 1 day ago

- 7 min read

Keeping up with financial paperwork can feel overwhelming for small and medium business owners in Garforth. Traditional accounting often ties you down to one office and rarely offers the flexibility you need. Cloud accounting platforms bring you real-time financial data access and HMRC compliance, making your accounting process smoother and more manageable. This guide highlights the strengths, common myths, and features that matter most for British businesses, helping you make informed decisions about your next accounting solution.

Table of Contents

Key Takeaways

Point | Details |

Cloud Accounting Advantages | Offers real-time financial tracking, enhanced data security, and automatic updates, making it beneficial for UK businesses. |

Common Misconceptions | Businesses may hesitate to adopt cloud accounting due to myths about security and complexity, despite robust compliance with UK regulations. |

Choosing the Right Platform | Evaluate specific business needs and opt for MTD-compatible software for seamless tax reporting and compliance. |

Security and Risks | Understand potential cybersecurity risks, but recognise that leading providers implement strong protective measures to safeguard data. |

Cloud accounting defined and common myths

Cloud accounting represents a transformative approach to financial management where businesses store and process accounting data using remote internet-based platforms. Unlike traditional accounting methods confined to local computer systems, cloud computing platforms enable real-time financial tracking from anywhere with internet connectivity.

The fundamental concept involves storing financial records, software, and computational resources on external servers instead of local infrastructure. This approach provides several strategic advantages for UK businesses:

Instant accessibility from multiple devices

Real-time data synchronisation

Reduced hardware maintenance costs

Enhanced data security through professional hosting

Automatic software updates

Scalable computing resources

Many businesses harbour misconceptions about cloud accounting that prevent them from adopting these powerful technologies. Regulatory compliance concerns often stem from misunderstandings about data protection and legal frameworks. Modern cloud accounting platforms adhere to strict UK financial regulations, providing robust security protocols that frequently exceed traditional on-premise systems.

Common myths about cloud accounting include unfounded concerns about data security, complexity, and reliability. In reality, cloud platforms offer sophisticated encryption, regular backups, and professional management that most small businesses cannot independently maintain.

Pro tip: Start by selecting a cloud accounting solution with UK-specific compliance certifications and robust data protection mechanisms.

Types of cloud accounting platforms in the UK

The United Kingdom offers a diverse range of cloud accounting platforms tailored specifically for businesses of different sizes and industries. UK accounting software landscape demonstrates significant variety in features, pricing, and compliance capabilities.

Key cloud accounting platforms in the UK market include:

Here’s a comparative overview of leading UK cloud accounting platforms to help inform your choice:

Platform | Typical User | Notable Strength |

Xero | SMEs | User-friendly, strong reporting |

QuickBooks Online | Startups, SMEs | Extensive integrations |

Sage Business Cloud | Large enterprises | Scalable for complex needs |

FreeAgent | Freelancers, sole traders | Simplicity, tax support |

Pandle | Micro-businesses | Affordability, easy setup |

FreshBooks | Project-based businesses | Invoicing, time tracking |

Xero: Ideal for small to medium enterprises

QuickBooks Online: Strong integration capabilities

Sage Business Cloud: Comprehensive enterprise solutions

FreeAgent: Designed for freelancers and sole traders

Pandle: Budget-friendly option for micro-businesses

FreshBooks: Project-based accounting specialist

Making Tax Digital compliance is a crucial consideration for UK businesses when selecting a cloud accounting platform. Accounting platform comparisons reveal that each software offers unique strengths in supporting HMRC’s digital tax reporting requirements.

The selection of a cloud accounting platform depends on several critical factors, including business size, industry complexity, budget constraints, and specific reporting needs. Smaller businesses might prioritise cost-effectiveness and simplicity, while larger enterprises require more sophisticated integration and reporting capabilities.

Pro tip: Evaluate your specific business requirements and conduct a trial of multiple platforms before making a final selection.

Key features and automation benefits

Cloud accounting automation represents a transformative approach to financial management, enabling businesses to streamline their operational processes dramatically. Accounting software improvements demonstrate significant potential for reducing manual workload and enhancing overall efficiency.

Key automated features that deliver substantial benefits include:

Automatic bank reconciliation

Real-time financial reporting

Instant invoice generation

Automated expense tracking

Seamless tax calculation

Integrated payroll processing

Compliance document preparation

The strategic advantages of these automation capabilities extend far beyond simple time-saving. Cloud accounting automation tools dramatically reduce human error risks, provide comprehensive audit trails, and enable accountants to focus on higher-value advisory work.

By implementing intelligent automation, UK businesses can transform their financial management approach. Smaller enterprises gain access to sophisticated tools previously available only to large corporations, levelling the technological playing field and enabling more strategic decision-making.

Pro tip: Prioritise platforms offering comprehensive automation features that align closely with your specific business reporting requirements.

Ensuring HMRC and Making Tax Digital compliance

The Making Tax Digital initiative represents a significant transformation in how UK businesses manage their tax reporting and financial record-keeping. Digital tax submission requirements will fundamentally change compliance procedures for sole traders and landlords from April 2026.

Key compliance requirements for businesses include:

Maintaining digital financial records

Using MTD-compatible accounting software

Submitting quarterly digital tax updates

Creating accurate digital tax records

Implementing secure digital record-keeping systems

Preparing for automatic digital tax submissions

Businesses must understand that this is not merely a technological shift, but a comprehensive approach to financial transparency. The HMRC mandates that all digital records must be:

Accurate and complete

Stored securely

Easily retrievable

Prepared using compatible software

Small and medium enterprises will need to invest in robust cloud accounting platforms that seamlessly integrate with HMRC’s digital infrastructure. This transition requires careful planning, staff training, and potentially professional guidance to ensure full compliance.

Pro tip: Begin exploring MTD-compatible software at least six months before the compliance deadline to allow sufficient time for system implementation and staff training.

Costs, risks, and data security issues

Cloud accounting security demands careful consideration for UK businesses evaluating digital financial management solutions. Cybersecurity challenges in cloud accounting highlight the complex landscape of digital financial protection and regulatory compliance.

Primary risks businesses must evaluate include:

Data breach potential

Unauthorized access vulnerabilities

Compliance regulation failures

Network infrastructure weaknesses

Potential financial data exposure

Third-party vendor security limitations

Leading cloud providers implement sophisticated security measures to mitigate these risks. Multi-factor authentication, end-to-end encryption, and continuous monitoring represent standard protective strategies that significantly reduce potential vulnerabilities.

Cloud accounting security trends demonstrate that while concerns exist, most professional accountants now trust cloud platforms due to robust security protocols. The benefits of cloud accounting – including automatic backups, enhanced accessibility, and improved productivity – increasingly outweigh potential risks.

Pro tip: Conduct thorough due diligence on potential cloud accounting providers, focusing specifically on their security certifications, data protection policies, and compliance track records.

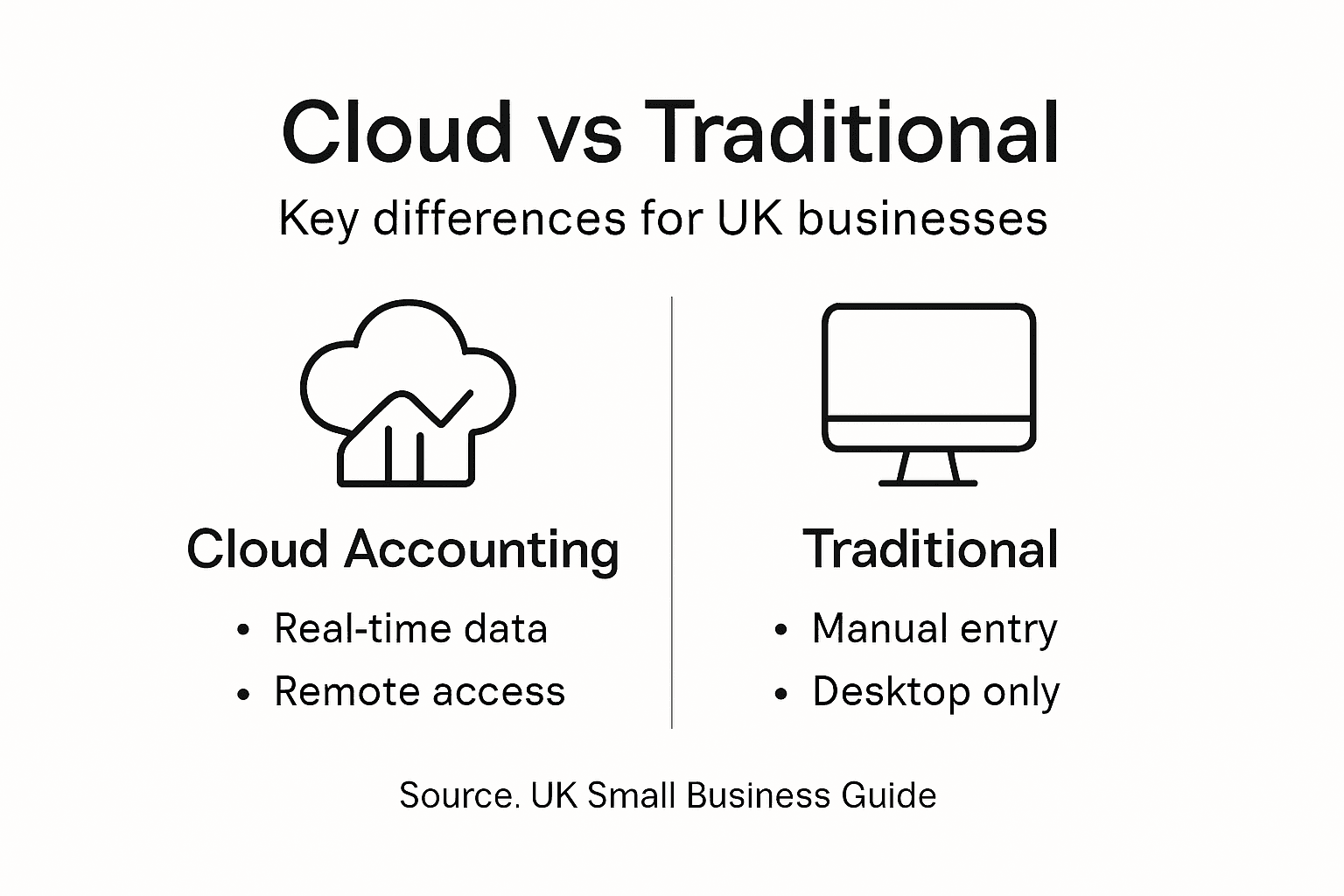

Comparing cloud and traditional accounting options

The evolution of financial management technologies has created a stark contrast between traditional and cloud accounting approaches. Accounting software transformation reveals significant differences in accessibility, efficiency, and operational capabilities.

Key distinctions between traditional and cloud accounting include:

Data accessibility

Update mechanisms

Collaboration potential

Scalability of systems

Cost of infrastructure

Real-time reporting capabilities

Security management

Traditional accounting typically involves localised software with limited remote access, manual data entry, and restricted collaborative features. In contrast, cloud accounting solutions provide dynamic, flexible financial management platforms that enable instant data synchronisation and comprehensive reporting.

The following table contrasts key aspects of cloud versus traditional accounting for UK businesses:

Dimension | Cloud Accounting | Traditional Accounting |

Data Access | Anywhere with internet | Limited to local machines |

Collaboration | Multiple users in real-time | Often single user at a time |

Software Updates | Automatic, seamless | Manual, requires IT support |

Scalability | Easily adjusted as needed | Costly and complex to expand |

Small and medium UK enterprises particularly benefit from cloud accounting’s ability to reduce administrative overhead, provide real-time financial insights, and support seamless integration with other business systems. The shift represents more than a technological upgrade – it’s a fundamental reimagining of financial data management.

Pro tip: Assess your business’s specific workflow requirements before transitioning, ensuring the chosen accounting solution aligns precisely with your operational needs.

Unlock the Full Potential of Cloud Accounting for Your UK Business

Transitioning to cloud accounting is more than adopting new software it is about embracing a smarter, more efficient way to manage your financial operations with real-time insights and full compliance with HMRC’s Making Tax Digital requirements. If you find yourself overwhelmed by complex tax rules, worried about data security, or uncertain which platform fits your needs Concorde Company Solutions provides personalised accounting services designed to bridge the gap between technology and your business goals.

Partner with experts who understand the critical importance of accurate, secure digital records and can guide you through payroll management, bookkeeping, and software setup tailored specifically for small to medium-sized UK businesses and sole traders. Visit Concorde Company Solutions today to start streamlining your accounts and unlock the benefits of cloud accounting with confidence. Don’t wait until the compliance deadline act now to safeguard your business’s financial future and gain peace of mind with professional support every step of the way.

Frequently Asked Questions

What is cloud accounting?

Cloud accounting is a financial management approach where businesses store and process accounting data on remote internet-based platforms, allowing for real-time financial tracking and accessibility from multiple devices.

What are the benefits of using cloud accounting for my business?

Cloud accounting offers advantages such as instant accessibility, reduced hardware maintenance costs, enhanced data security, automatic software updates, and scalability, which can help streamline financial management processes.

How does cloud accounting ensure data security?

Leading cloud accounting providers implement sophisticated security measures such as multi-factor authentication, end-to-end encryption, regular backups, and professional management to protect financial data from breaches and unauthorized access.

Are cloud accounting platforms compliant with UK regulations?

Yes, modern cloud accounting platforms adhere to strict UK financial regulations, providing robust security protocols and compliance features necessary for accurate record-keeping and tax reporting.

Recommended

Comments