Role of Accountancy Firms: Complete UK Guide

- David Rawlinson

- Nov 22, 2025

- 7 min read

Nearly every british business relies on accountancy firms to keep their finances in order, yet few realise just how vital these professionals are. Members of accountancy bodies work with over 80 percent of FTSE 100 companies, shaping financial decisions at every level. As regulations tighten and business challenges grow more complex, understanding what defines an accountancy firm in the UK becomes crucial. This guide reveals the different types of firms, their key services, and what makes them essential to financial success.

Table of Contents

Key Takeaways

Point | Details |

Role of Accountancy Firms | Accountancy firms provide vital financial services such as tax planning and financial reporting to ensure compliance and aid business growth. |

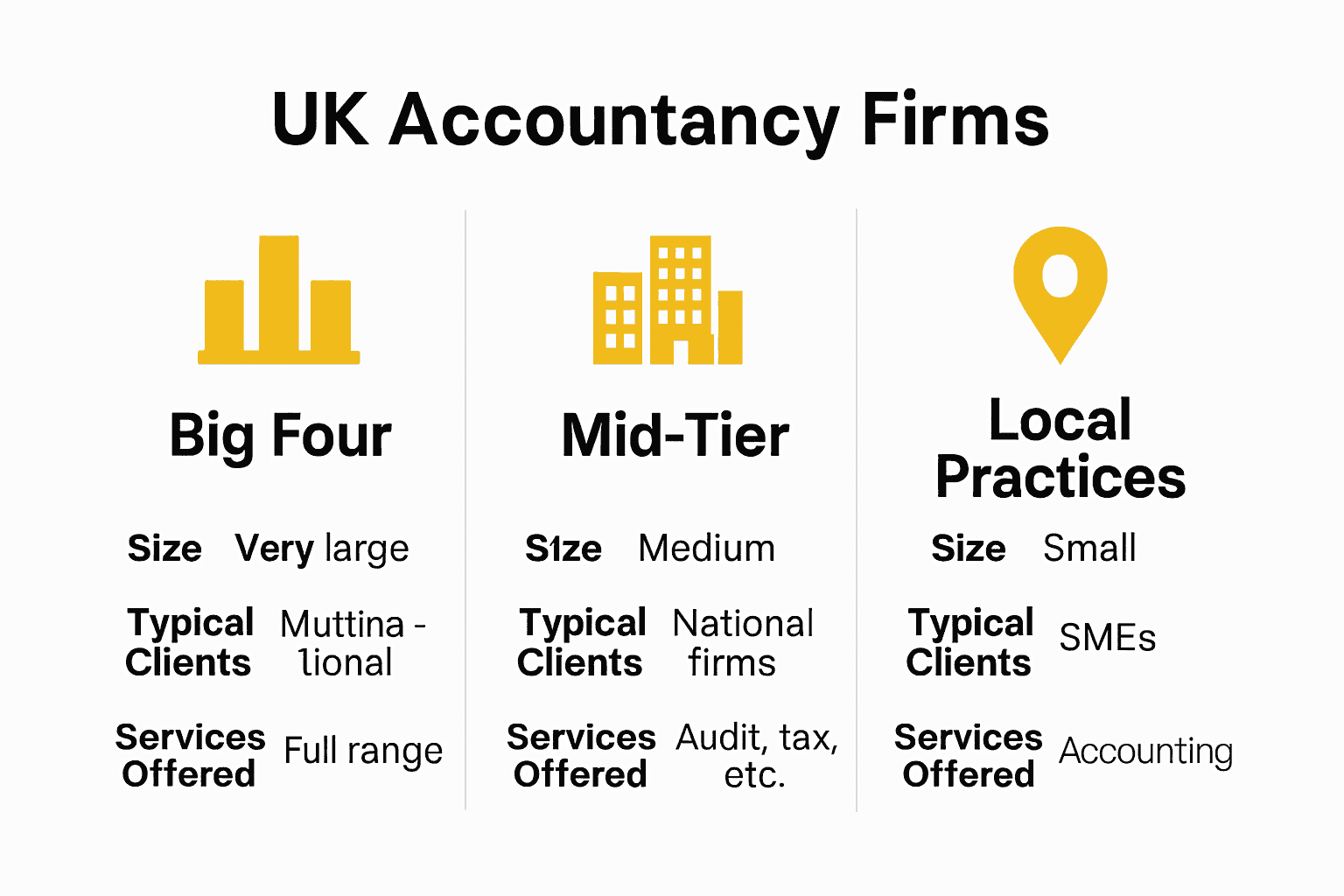

Types of Accountancy Firms | The UK accounting landscape includes multinational firms (Big Four), mid-tier firms, and local practices, catering to varying business needs. |

Legal and Ethical Compliance | Accountancy professionals must adhere to strict regulatory standards and ethical guidelines to maintain transparency and integrity in financial reporting. |

Risk Management | Firms face significant professional liability risks and must implement comprehensive insurance and protection strategies to mitigate potential financial exposures. |

Defining accountancy firms in UK

Accountancy firms are professional organisations that provide critical financial services to businesses, individuals, and organisations across the United Kingdom. These specialised businesses help clients manage their financial records, ensure regulatory compliance, and offer strategic financial guidance. According to ICAS, these professionals play pivotal roles in business ecosystems, with members working in 80% of FTSE 100 companies.

At their core, accountancy firms deliver a range of essential services including financial reporting, tax planning, audit support, bookkeeping, and strategic financial advice. ACCA Global highlights that these firms are not merely number-crunchers but strategic partners helping businesses navigate complex financial landscapes. Their professionals are trained to interpret financial data, identify potential risks, and provide actionable insights that can drive business growth.

In the UK context, accountancy firms are regulated by professional bodies like the Institute of Chartered Accountants (ICAS) and the Association of Chartered Certified Accountants (ACCA). These organisations ensure that accounting professionals maintain high standards of professional competence, ethical conduct, and technical expertise. Firms can range from small local practices serving small businesses and sole traders to large multinational organisations working with global corporations.

Key functions of UK accountancy firms typically include:

Preparing statutory accounts

Managing company tax returns

Providing payroll services

Offering bookkeeping support

Developing financial strategies

Ensuring HMRC compliance

For businesses in Leeds and Garforth seeking expert financial guidance, local accountancy services can provide tailored support that addresses specific business needs and challenges.

Different types of accountancy firms

Accountancy firms in the United Kingdom represent a diverse ecosystem with multiple categories and service models. Careers Oxford highlights that these firms range from large multinational corporations to small local practices, each serving unique business needs and specialisations.

Multinational Accountancy Firms dominate the top tier of the UK accounting landscape. Known as the ‘Big Four’ - Deloitte, EY, KPMG, and PwC - these organisations provide comprehensive global services including audit, tax advisory, management consulting, and financial strategy. They typically work with large corporations, handling complex international financial requirements and offering extensive resources and expertise.

Mid-tier Firms occupy an important middle ground in the accountancy sector. These organisations are smaller than the Big Four but larger than local practices, often specialising in specific industries or regional markets. They provide similar services to larger firms but with more personalised attention and often more competitive pricing structures.

Local Accountancy Practices form the grassroots of the UK accounting world. These smaller firms are crucial for small businesses, sole traders, and local enterprises. They offer targeted services including:

Bookkeeping and record management

Tax return preparation

Payroll services

Basic financial advice

HMRC compliance support

For businesses in Leeds and Garforth seeking personalised financial guidance, virtual accounting services can provide flexible and tailored support that addresses specific business challenges.

Key services and how they operate

Accountancy firms deliver a comprehensive range of financial services designed to support businesses and individuals throughout their financial journey. Careers Oxford confirms that chartered accountants typically work across multiple client portfolios, conducting detailed audits, tracking financial trends, and providing strategic business advice.

Financial Reporting and Audit Services form the cornerstone of most accountancy firm operations. These services involve meticulously examining financial statements, ensuring accuracy, compliance with regulatory standards, and identifying potential financial risks. Accountants perform comprehensive reviews of financial records, validate accounting processes, and provide independent assessments that help businesses maintain transparency and meet legal requirements.

Tax Advisory and Compliance represent another critical service area. Chartered accountants help clients navigate complex tax landscapes by developing strategic tax planning approaches, preparing accurate tax returns, and ensuring full compliance with HMRC regulations. This includes identifying potential tax efficiencies, managing corporate tax submissions, and providing guidance on tax implications of business decisions.

Key operational services typically include:

Statutory accounts preparation

Corporation tax return management

Payroll processing

Bookkeeping and financial record maintenance

Management accounting and financial reporting

Strategic financial planning

Business Consultancy extends beyond traditional accounting functions. Nottingham University notes that accountants now provide strategic recommendations ranging from individual financial planning to complex corporate financial strategies. This consultative approach helps businesses make informed decisions, optimise financial performance, and navigate economic challenges.

For businesses in Leeds and Garforth seeking comprehensive financial support, virtual accounting solutions offer flexible, tailored services that adapt to specific business needs and operational contexts.

Legal obligations and compliance duties

Accountancy firms operate within a complex regulatory environment that demands rigorous adherence to legal and professional standards. ACCA Global emphasizes that professional accountancy bodies work in the public interest, ensuring members maintain the highest levels of ethical and professional conduct across all financial operations.

Regulatory Compliance represents a critical aspect of accountancy practice. Professional accountants must navigate multiple layers of legal requirements, including financial reporting standards, tax regulations, and industry-specific compliance protocols. This involves maintaining meticulous records, submitting accurate financial statements, and ensuring full transparency in all financial reporting to regulatory bodies such as HMRC, Companies House, and sector-specific regulators.

Professional Ethics and Standards form the cornerstone of accountancy legal obligations. Chartered accountants are bound by strict ethical guidelines that require:

Maintaining client confidentiality

Avoiding conflicts of interest

Demonstrating professional integrity

Providing objective and independent financial advice

Continuously updating professional knowledge

Reporting any potential financial irregularities

IFAC highlights the importance of public sector accounting standards, which extend beyond private sector practices. Professional bodies like the Chartered Institute of Public Finance and Accountancy (CIPFA) work to advance public finance practices and implement robust international accounting standards across various sectors.

Key legal compliance duties include:

Adhering to UK accounting standards

Maintaining accurate financial records

Submitting timely tax returns

Protecting client financial information

Reporting potential financial misconduct

For businesses in Leeds and Garforth seeking expert guidance on navigating these complex legal requirements, virtual accounting services offer comprehensive support to ensure full regulatory compliance.

Risks, costs and liabilities involved

Accountancy firms face complex financial and professional risks that require strategic management and comprehensive protection strategies. ACCA Global confirms that professional practitioners must comply with stringent regulatory requirements, including mandatory liability insurance and regular professional inspections to mitigate potential financial and legal exposures.

Professional Liability Risks represent a significant challenge for accountancy practices. These risks emerge from potential errors in financial reporting, tax advice, or strategic recommendations that could result in financial losses for clients. Accountants can be held legally responsible for professional negligence, with potential consequences including financial compensation claims, professional disciplinary actions, and damage to professional reputation.

Key financial risks and liability considerations include:

Potential legal claims from clients

Financial compensation for professional errors

Reputational damage from incorrect advice

Regulatory penalties and sanctions

Professional indemnity insurance costs

Compliance monitoring expenses

Insurance and Protection Mechanisms are crucial for managing these risks. ICAS highlights that professional bodies like themselves provide designated licensing and regulatory frameworks to protect both practitioners and clients. Chartered Accountants are required to maintain comprehensive professional indemnity insurance, which typically covers:

Legal defence costs

Financial compensation claims

Professional misconduct investigations

Errors and omissions in professional services

Cost considerations for accountancy firms include:

Professional liability insurance premiums

Regulatory compliance expenses

Ongoing professional development

Quality assurance and audit costs

Technology and software investments

For businesses in Leeds and Garforth seeking transparent and risk-managed financial services, virtual accounting solutions offer professional support with clear liability frameworks and comprehensive protection strategies.

Discover How Expert Accountancy Support Transforms Your Business

Navigating the complex world of UK financial regulations, tax compliance and strategic planning can feel overwhelming. This article highlights critical challenges such as maintaining accurate statutory accounts, managing HMRC compliance and protecting your business from costly professional risks. If you are a small to medium-sized business or a sole trader in Leeds or Garforth seeking clarity and confidence in your financial affairs, personalised expert help is essential.

At Concorde Company Solutions, we understand the pressures of staying compliant while focusing on growth. Our dedicated team provides tailored services including company tax returns, payroll management and full bookkeeping support designed to minimise risk and optimise your financial performance. Benefit from transparent pricing and a partnership approach that puts your business goals first. Take control of your finances today by visiting our virtual accountancy services and experience professional support that evolves as your needs change. Don’t wait until a compliance issue or costly mistake arises – secure your financial peace of mind now with Concorde Company Solutions.

Frequently Asked Questions

What services do accountancy firms typically offer?

Accountancy firms generally provide a range of services including financial reporting, tax planning, audit support, bookkeeping, and strategic financial advice to help clients manage their finances effectively.

How do accountancy firms ensure compliance with regulations?

Accountancy firms ensure compliance by adhering to legal standards set by professional bodies, maintaining accurate financial records, and staying updated on tax regulations and financial reporting requirements.

What are the potential risks associated with using accountancy firms?

Potential risks include professional liability for errors in financial reporting or advice, legal claims from clients, and reputational damage if the firm fails to meet regulatory standards or client expectations.

How do accountancy firms charge for their services?

Accountancy firms may charge for their services through hourly rates, fixed fees for specific projects, or retainer agreements based on the ongoing services provided. Costs can vary depending on the complexity and scope of the services required.

Recommended

Comments