Guide to Bookkeeping Basics for Small Businesses UK

- Richard Ellis

- 3 days ago

- 8 min read

Managing business finances can quickly become confusing for small business owners in Garforth, Leeds, especially when faced with the demands of HMRC. Choosing the right bookkeeping methods and keeping records organised throughout the tax year are key to maintaining financial clarity. This guide highlights practical bookkeeping basics tailored for United Kingdom small businesses, helping you confidently select tools, document transactions, and prepare for HMRC requirements.

Table of Contents

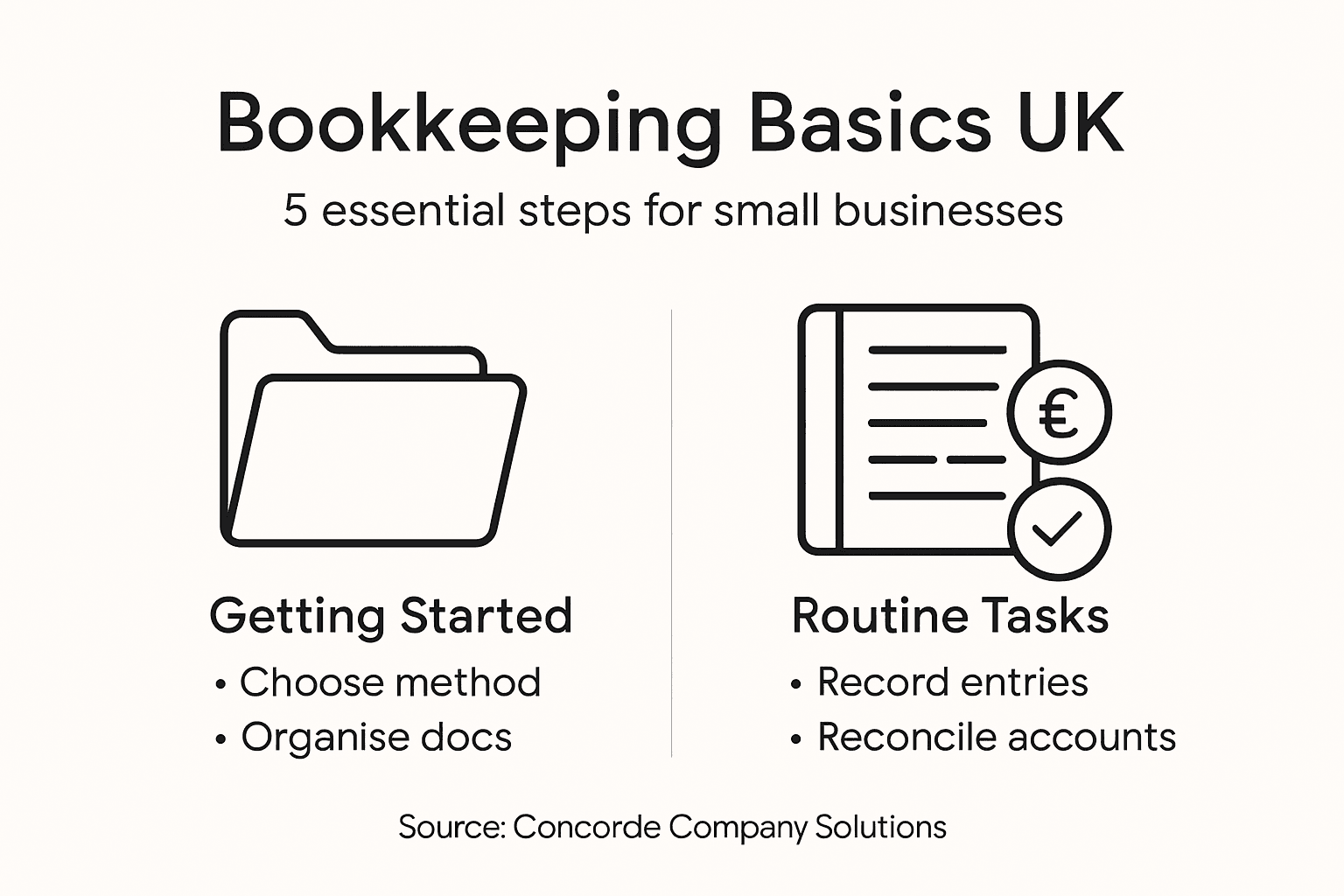

Quick Summary

Key Point | Explanation |

1. Choose the Right Bookkeeping Method | Select a bookkeeping approach that fits your business size, transaction volume, and budget for optimal financial management. |

2. Organise Financial Documents Effectively | Maintain systematic and digitised records of essential financial documents for compliance and quick retrieval, streamlining tax preparation. |

3. Consistently Record Transactions | Develop a routine of accurate transaction recording to ensure compliance with HMRC regulations and clear insights into financial health. |

4. Reconcile Accounts Regularly | Regularly compare internal records with bank statements to identify discrepancies and enhance the accuracy of your financial records. |

5. Prepare Thoroughly for HMRC Submissions | Gather and review all financial documentation well in advance of deadlines to ensure accurate tax reporting and compliance with regulations. |

Step 1: Choose appropriate bookkeeping methods and tools

Choosing the right bookkeeping approach is crucial for managing your small business’s financial health in the United Kingdom. Understanding your options will help you select a method that matches your business complexity, budget, and reporting needs.

Small businesses typically have three primary bookkeeping methods to consider: manual bookkeeping, spreadsheet-based tracking, and digital accounting software. Bookkeeping methods for small businesses can vary significantly depending on your company’s size and financial complexity.

Consider these factors when selecting your bookkeeping approach:

Business size and transaction volume

Budget for accounting tools

Technical comfort level

Reporting requirements

Growth potential

Manual bookkeeping works best for very small businesses with minimal transactions, while digital solutions become increasingly valuable as your business scales. Digital accounting platforms offer real-time financial insights, automated reporting, and seamless integration with banking systems.

Here’s a comparison of popular bookkeeping approaches for UK small businesses:

Approach | Ideal Business Type | Key Benefit | Potential Limitation |

Manual bookkeeping | Micro business, sole traders | No software costs | Prone to errors, time-consuming |

Spreadsheet tracking | Small teams, early-stage | Flexible setup, affordable | Limited automation, security concerns |

Cloud accounting software | Growing or tech-enabled firms | Real-time tracking, integration | Monthly fee, learning curve |

Selecting the right bookkeeping method is not just about tracking expenses - it’s about gaining strategic financial visibility for your business.

For most UK small businesses, cloud-based accounting software provides the most flexible and comprehensive solution. These tools offer features like automatic bank feeds, invoice tracking, expense categorisation, and easy HMRC tax reporting.

Top tip: Start with a flexible digital accounting solution that can grow alongside your business, reducing the need for complex migrations later.

Step 2: Organise essential financial documents for accuracy

Effective document organisation is a critical skill for small business owners to maintain financial accuracy and comply with HMRC regulations. Properly managing your financial paperwork will save you time, reduce stress during tax season, and ensure you’re prepared for potential audits.

Record keeping requirements from HMRC mandate that self-employed businesses maintain comprehensive documentation for at least five years after the relevant tax submission deadline. Your organisational system should include digital and physical copies of key financial documents.

Essential documents to collect and organise systematically include:

Sales invoices

Purchase receipts

Bank statements

Expense records

Payroll documentation

Tax correspondence

Digital filing systems provide significant advantages for modern small businesses. These platforms allow you to scan, categorise, and store documents securely, making retrieval quick and straightforward. Many accounting software solutions offer integrated document management features that automatically categorise and store financial records.

This summary shows how digital record management enhances compliance and efficiency:

Feature | Compliance Impact | Efficiency Boost | Practical Example |

Automated backups | Reduces risk of document loss | Saves manual storage time | Cloud storage with routine backups |

Integrated scanning | Ensures accurate HMRC records | Quick document retrieval | Mobile app receipt upload |

Secure cloud access | Maintains privacy standards | Enables remote working | Access documents from anywhere |

Consistent document organisation is not just about compliance - it’s about gaining clear financial visibility for your business.

Adopt a structured approach to document management by creating clear, logical folder systems. Consider using chronological and categorical subfolders to ensure easy navigation. Cloud storage solutions provide additional benefits like automatic backups and remote access.

Top tip: Invest in a reliable digital document management system that integrates with your accounting software, enabling seamless record-keeping and reducing manual filing time.

Step 3: Record transactions consistently and correctly

Accurate financial record-keeping is fundamental to understanding your business’s financial health and maintaining compliance with HMRC regulations. Developing a systematic approach to tracking every financial transaction will provide clear insights into your business performance and simplify tax preparation.

Self-employed record-keeping requirements mandate precise documentation of all income and expenses throughout the tax year. The method you choose - whether cash basis or traditional accounting - will determine how and when you record specific transactions.

Key principles for consistent transaction recording include:

Date every transaction accurately

Record gross transaction amounts

Include comprehensive transaction details

Categorise expenses consistently

Maintain separate business and personal accounts

Keep digital and physical transaction copies

Digital accounting tools can significantly streamline your transaction recording process. These platforms often provide automatic bank feed integration, enabling real-time transaction tracking and reducing manual data entry errors. Many solutions offer categorisation suggestions and receipt scanning capabilities to simplify your bookkeeping workflow.

Consistent transaction recording is not just a regulatory requirement - it’s your financial roadmap for business success.

When recording transactions, establish a routine that works for your business rhythm. Some entrepreneurs prefer daily updates, while others might reconcile transactions weekly. The key is maintaining regularity and ensuring no transaction goes unrecorded.

Top tip: Set aside dedicated time each week to update your financial records, treating it as a non-negotiable business appointment to maintain impeccable transaction tracking.

Step 4: Reconcile accounts to verify financial records

Account reconciliation is a critical process that ensures the accuracy of your financial records and provides a clear picture of your business’s financial health. By systematically comparing your internal financial records against external statements, you can identify and resolve discrepancies before they become significant issues.

HMRC record-keeping requirements emphasise the importance of regular financial reconciliation to maintain accurate and reliable accounting records. This process helps protect your business from potential errors, fraud, and compliance challenges.

Key steps for effective account reconciliation include:

Compare bank statements with bookkeeping records

Verify all transaction amounts

Investigate and explain any discrepancies

Document reconciliation process

Flag unusual or unexpected transactions

Maintain a consistent reconciliation schedule

Modern accounting software can significantly simplify the reconciliation process. These tools often provide automated matching features, highlighting potential discrepancies and reducing the manual effort required to cross-reference multiple financial documents.

Reconciliation is not just about balancing numbers - it’s about understanding the financial story behind your business transactions.

Establish a regular reconciliation routine that aligns with your business operations. Most small businesses benefit from monthly reconciliations, though some might require more frequent reviews depending on transaction volume and complexity.

Top tip: Create a dedicated reconciliation checklist to ensure consistency and thoroughness in your financial review process.

Step 5: Review and prepare for HMRC submissions

Preparing for HMRC submissions requires meticulous attention to detail and a strategic approach to financial reporting. Understanding the submission requirements and maintaining organised records will help you navigate the tax reporting process smoothly and avoid potential penalties.

Self-employed record submission requirements outline the critical steps small businesses must take to ensure accurate and timely tax reporting. The digital landscape of tax submissions demands precise documentation and adherence to Making Tax Digital (MTD) guidelines.

Key elements to focus on during HMRC submission preparation include:

Gather all financial documents

Reconcile financial statements

Calculate accurate tax liabilities

Review expense categorisations

Verify income and expenditure records

Ensure digital record-keeping compliance

Digital accounting platforms have transformed the submission process, offering integrated tools that streamline tax reporting. These solutions provide real-time insights, automatic calculations, and direct submission interfaces that simplify compliance with HMRC regulations.

Effective HMRC submission preparation is not just about meeting deadlines - it’s about presenting a clear, accurate financial narrative of your business.

Timely preparation is crucial. Start gathering and reviewing documents well in advance of submission deadlines, allowing sufficient time for thorough verification and potential corrections. Consider setting up reminders and creating a comprehensive checklist to track your progress.

Top tip: Develop a dedicated folder system for tax-related documents and set calendar alerts three months before each submission deadline to ensure comprehensive and stress-free preparation.

Take Control of Your Bookkeeping with Expert Support from Concorde Company Solutions

Managing your small business bookkeeping in the United Kingdom can be challenging when facing complex transaction recording, document organisation, and compliance with HMRC requirements. If you find yourself overwhelmed by maintaining consistent records or reconciling accounts accurately you are not alone. Many business owners share the goal of gaining clear financial visibility while avoiding costly errors and time-consuming manual processes.

At Concorde Company Solutions we understand these pain points and specialise in delivering personalised bookkeeping and accounting services tailored for small to medium-sized businesses and sole traders. Our expertise includes setting up cloud accounting software, preparing statutory accounts, and ensuring your tax submissions meet the latest HMRC standards. With our transparent pricing and dedicated support based in Garforth Leeds, we act as your reliable financial partner so you can focus on growing your business with confidence.

Ready to transform your bookkeeping practices into a streamlined and stress-free process Visit Concorde Company Solutions today to explore our range of services including bookkeeping and tax return assistance. Do not wait until errors or missing records impact your business success Contact us now for a personalised consultation and take the first step towards impeccable financial management.

Frequently Asked Questions

What bookkeeping method should I choose for my small business?

Choosing the right bookkeeping method depends on your business size and transaction volume. For very small businesses, manual bookkeeping might suffice, while cloud accounting software is better for growing businesses. Evaluate your budget and technical comfort to make a suitable choice.

How can I organise my financial documents for better bookkeeping?

To effectively organise your financial documents, create a structured digital filing system. Use categories such as sales, purchases, and taxes, and consider chronologically sorting the documents within each category to simplify retrieval and ensure compliance with record-keeping requirements.

What is the importance of transaction recording in bookkeeping?

Recording transactions accurately is crucial for maintaining financial health and complying with regulations. Establish a routine for updating your records consistently, ensuring every transaction is entered within a set timeframe, such as weekly, to avoid missing any financial details.

How often should I reconcile my accounts?

You should reconcile your accounts at least once a month to verify the accuracy of your financial records. This process allows you to catch discrepancies early and helps maintain a clear financial picture of your business, enabling informed decision-making.

What steps should I take to prepare for HMRC submissions?

Prepare for HMRC submissions by gathering all relevant financial documents, reconciling your accounts, and verifying income and expenses. Implement a checklist to ensure you have everything necessary for a smooth submission, ideally starting this process three months before deadlines.

How can digital accounting tools improve my bookkeeping process?

Digital accounting tools enhance your bookkeeping process by automating transaction tracking and integrating various financial tasks. Choose a solution that fits your needs, and aim to reduce manual entry errors by utilising features like automatic bank feeds and document management.

Recommended